Class of 2020 Set to Spend Millions for College Tuition, When Will It Change?

March 11, 2020

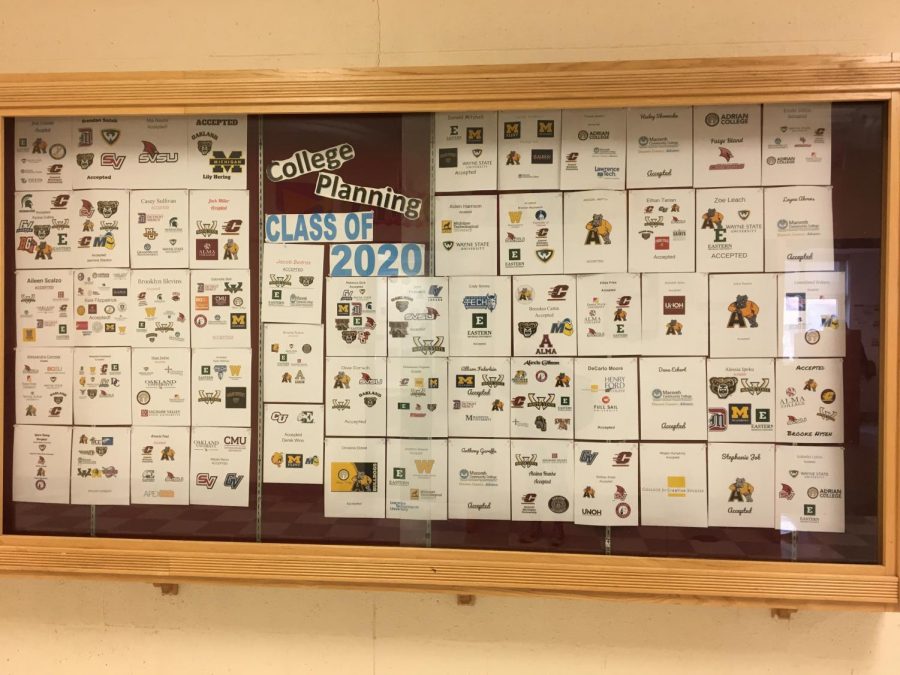

This year’s graduating senior class is preparing for what awaits them outside Lake Shore’s walls. Many of our students have gone the traditional college route, but is the four-year university degree becoming a luxury few of us can afford?

A recent statistic from the Labor Department reported that the cost of college has increased at a rate of 1120% (yes, 1120%), since 1978. In today’s workforce, a college degree is an expensive necessity that many of our students will be paying off for decades to come. Some of our seniors are already crunching the numbers on how they are going to be paying for one of the biggest expenses they will have to pay in their lifetime. For students who are not fortunate enough to afford student loan debts of almost 27,000 dollars, they feel like they are being shut out of an education that they are entitled to receive.

Senior Samantha Lundy is set to attend University of Detroit Mercy in the fall. When looking at her future after college, Lundy said, “I don’t think it’s fair to spend all of this money just to get a job to be paying it back for the rest of my life.” Her stance is not uncommon amongst the graduating seniors. Lake Shore’s graduating class has a lot to say, and this topic is not one to be taken lightly.

The cost of a four-year university has increased almost tenfold since the time our grandparents went to college. The National Center for Education Statistics calculated the average cost to attend a four year university for the 1977-1978 school year, as $2,967 ($11,749 when adjusted for inflation). That figure included tuition, and room and board for a four year degree. For comparison, the statistic for the 2017-2018 school year totalled at a whopping $34,740. As if the expense was not prohibitive enough, colleges are continuing to increase their standards, raising the minimum GPA, and SAT requirements to even be considered for admission. Students are being worked harder than ever to pay more than they have ever had to pay previously. Lake Shore is seeing the effects in its seniors.

Graduating senior Samantha Dreisbach is already feeling the pressure. She explains, “We are very stressed, I kind of feel like I’m already drowning in debt, I got a 5,000 loan along with a small scholarship, but tuition is 27,000.” Even the students who worked hard enough to receive a scholarship are still scrambling to fill the gaps in the monumental cost of tuition. The class of 2020 is being spread thin. Students will have to work a lifetime to pay for the college education that is necessary for a job in the white-collar industry. Some students who cannot afford the tuition, simply will not attend. This raises the question: is the four-year university degree still attainable for the average high school senior?

Universities can afford to be choosy. The competition for admission into the best schools is fierce, and students without exceptional academics, extra-curriculars, and community service are already behind. Students are being worked harder than ever to compete with the millions of other hard-working and dedicated competitors that are fighting for the same opportunities that they are. Our seniors are feeling the strain.

Lundy explains that she feels like there is no other option. She said, “School is so expensive, and we are all taught to have a good future, you have to get a good education, I don’t think it’s fair.” Each year, our seniors have to make this monumental decision that will impact them for the rest of their lives, but many feel like they do not have a choice. The same message is drilled into the curriculum since freshman year, to succeed is to get a college degree, but a college degree cannot be obtained for pocket change anymore. Because this mind set is continuing, students are spending fortunes just to be able to compete. Those without, are left with a distinct disadvantage when going into the workforce.

Lake Shore’s seniors feel like they are stuck in a rut. The idea of spending a quarter of a million dollars on a college education doesn’t appeal to most. However, it’s the necessity of that degree that sends millions of students deep into debt. The programs intended to soften the blow of student debt are not enough. Students who are granted scholarships and receive loans still have to pay thousands out of pocket for tuition, room and board, and books. This is a fraction of the expenses these students will face in the next four years. The attitude of Lake Shore’s seniors is that the universities do not care about if they will be able to pay their way through their programs. Universities charging students thousands upon thousands of dollars do not care if they only eat instant noodles and granola bars for four years because they are broke. The poor college student life is even idolized today, it is now the standard that going to college means you will barely have enough to live off of until you get your degree.

Lake Shore seniors, like each of the classes before them, are left facing the music. Universities are more focused on jacking up the price of tuition to profit, than they are actually giving their students the best education they can provide. Without the power to change it individually, all we can do is follow in our previous classes steps, listen to Kanye West’s College Dropout, and hope for change.